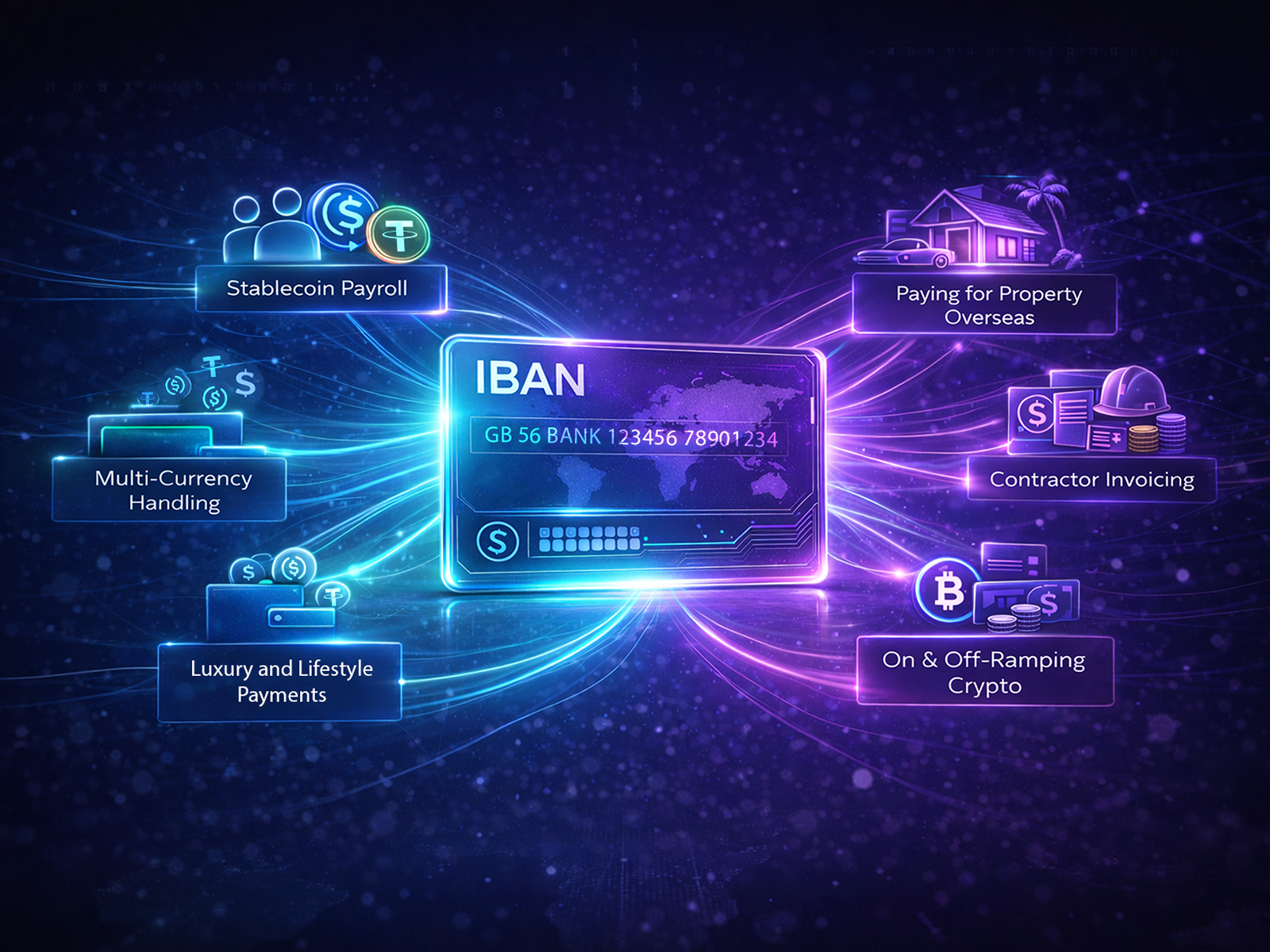

Six powerful use cases for virtual IBANs

It's no secret that legacy banking infrastructure is fraught with friction – particularly for international payments. Whether you're a freelance marketer in the UK waiting too long for an overseas invoice to clear, or a business in Dubai juggling several multi-currency accounts, what should be straightforward often comes with delays, hidden fees and reconciliation headaches. Virtual IBANs offer a more streamlined solution.

While they look and function like traditional IBANs (International Bank Account Numbers), virtual IBANs operate slightly differently. Rather than each being tied to a separate bank account, a virtual IBAN is a unique payment route that connects back to a single master account. A business can generate multiple virtual IBANs for different purposes, e.g. for receiving funds in different currencies, serving clients in different regions, or segmenting flows by project. The result is simpler reconciliation and faster settlement without the need to open and manage multiple accounts.

Below, we outline six practical use cases for virtual IBANs, from stablecoin payroll to international property transactions, and explore how they're helping individuals and businesses bypass the limitations of traditional finance.

1. Stablecoin payroll for remote teams

In a world that's more connected than ever, hiring globally is easy, but paying globally isn't always as smooth. Stablecoins like USDT and USDC solve part of the problem, but off-ramping into local fiat remains a major hurdle for remote teams. Virtual IBAN providers like SettlementX help bridge that gap by offering secure, compliant off-ramping into major fiat currencies, without requiring your team to manage crypto wallets or exchange accounts.

2. Paying for property overseas

From dealing with unfamiliar banks to relying on expensive remittance apps, buying a home abroad comes with its own set of challenges. Virtual IBANs help simplify this process by giving buyers a localised payment route in the same currency and jurisdiction as the seller, without the need to open a local bank account. For example, if you're a UK resident buying a home in Dubai, you can use a virtual IBAN platform like SettlementX to fund your account in pounds or stablecoins, convert the balance into dirhams, then transfer the amount to the developer or agent as a standard domestic payment – avoiding the delays and excessive FX fees of legacy rails.

3. Concierge, luxury and lifestyle payments

Not every payment is for payroll or property: sometimes, you simply want to enjoy the upside. Whether you're booking a private jet, renting a classic car for the weekend, or wiring the funds for your annual concierge membership, virtual IBANs make high-value personal spending much easier. With platforms like SettlementX, you can off-ramp your stablecoins into fiat to send directly to a vendor as a domestic transfer. This way, you circumvent card limits and exchange delays while enjoying compliant, frictionless spending.

4. Efficient multi-currency handling

For global businesses and digital nomads, collecting payments in different currencies often means juggling multiple accounts or paying substantial fees (if not both). With a virtual IBAN, you can issue region or client specific account numbers that link to one central account, making it easy to receive funds in GBP, EUR, AED, or USD without relying on local banking infrastructure. Clients pay into a virtual IBAN in their own currency, and the funds arrive clearly tagged and automatically routed, removing the FX clutter that usually complicates cross-border operations.

5. Seamless crypto on and off-ramping

For most, the magic of digital assets is that they're borderless, secure and traceable. The pain point is usually off-ramping into a local currency. With SettlementX, you can off-ramp stablecoins and other digital assets into major fiat currencies, handled compliantly by one of our 12 global banking partners. Funds land quickly and ready to use without intermediary hurdles, offering a quicker, compliant way to turn your crypto into cash.

6. Construction, contractor invoicing and vendor payments

If you're managing contractors across different regions, making cross-border payments can be time-consuming and expensive. SettlementX simplifies this by allowing you to fund your account in stablecoins or fiat, convert to the required currency, and send payments directly to your contractors' or vendors' local bank accounts under a named IBAN. Each payment can be tagged and tracked for easier reconciliation, giving you full visibility and control without the usual delays or FX inefficiencies.